Wages

Wages documented on the payslips/pay registers must show that you are compliant with legal regulations (minimum wages) and/or collective bargaining agreements (if applicable).

If payment is calculated per unit, employees must be able to earn at least the legal minimum wage (on average) within regular working hours.

If there are deductions from salaries that result in employees are being paid below minimum wage, these deductions must be justified in writing.

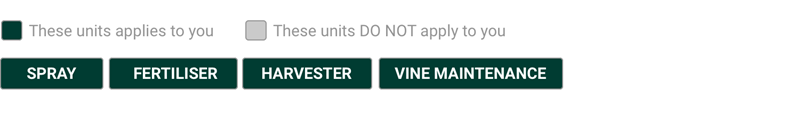

Payslips or pay registers must give a clear indication of the amount of compensated working time or harvested amount (hours/days). Your inspector will review a worker’s time recorded hours against payslips and check that information has been recorded correctly.

They will also check wages are aligned with pay rates in Employment Agreements and comply with labour regulations on pay rates.